The TAFS: The Universal Identifier for Federal Spending

Every dollar the federal government spends is tracked using a unique identifier that most people have never heard of.

Here's Section 249 from the FY 2026 Senate Transportation-HUD appropriations bill:

Sec. 249. (a) Any unobligated balances from amounts made available under the heading, "Community Development Fund" in chapter 9 of title II of the Emergency Supplemental Appropriations Act for Defense, the Global War on Terror, and Hurricane Recovery, 2006 (Public Law 109–234) that were transferred to "Management and Administration, Salaries and Expenses" are hereby permanently rescinded.

(b) Any unobligated balances included under Treasury Appropriation Fund Symbol 86 X 0108 from amounts transferred to the Department of Housing and Urban Development from amounts made available under the heading, "Unanticipated Needs" in chapter 8 of title I of the Emergency Supplemental Appropriations Act of 1994 (Public Law 103–211) are hereby permanently rescinded.

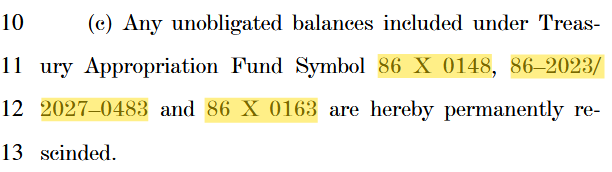

(c) Any unobligated balances included under Treasury Appropriation Fund Symbol 86 X 0148, 86–2023/2027–0483 and 86 X 0163 are hereby permanently rescinded.

(d) Of the unobligated balances from amounts included under Treasury Appropriation Fund Symbol 86 X 0304, $4,729,103.98 are hereby permanently rescinded.

You're an intrepid staffer, so you go to the Committee report and look for the description of Section 249. Here's what you see:

Section 249 rescinds certain unobligated balances.

Descriptive, but not particularly helpful.

Question: What programs just lost funding in subsection (c)?

If you can't read TAFS codes, you have no idea. The bill gives you three account identifiers—86 X 0148, 86-2023/2027-0483, and 86 X 0163—and no description. No program names, no appropriations bill reference, no explanation.

Unless you understand Treasury Appropriation Fund Symbols (TAFS), you're blindfolded.

This is how Congress actually writes appropriations law. Sometimes they use descriptive account titles (like subsection (a)'s "Community Development Fund"). But increasingly, they use TAFS codes—especially for rescissions, transfers, and technical provisions.

By the end of this post, you'll be able to decode those three accounts, understand exactly what programs were affected, and know where to look up any TAFS code you encounter in federal budget documents.

Quick Reference: Understanding TAFS Codes

What is a TAFS?

A Treasury Appropriations Fund Symbol (TAFS) is an identifier that uniquely identifies every federal spending account. It's the primary key in federal financial systems—the code that links appropriations to execution.

What does a TAFS look like?

012-2026-2027-3510

That's a real TAFS code for USDA's Women, Infants, and Children Program (WIC). Each component has a specific meaning that tells you what agency controls the money, how long it's available, and what program it funds.

Where do you find TAFS codes?

- Appropriations bills: Not common, but you will find them in rescission provisions

- OMB apportionments (SF-132): In the "TAFS" field at the top of each form

- SF-133 reports: In the "TAFS" column of the monthly Excel files

- USAspending.gov: In the "Treasury Account Symbol" field for every contract and grant

Why TAFS codes matter:

Without TAFS literacy, you can't answer basic questions like "What did Congress just rescind?" You can't connect appropriations bills to execution data. You can't track impoundments or identify spending delays.

Key question this post answers: What do those numbers and letters mean, and how do you use them to track federal spending?

Download a quick visual guide.

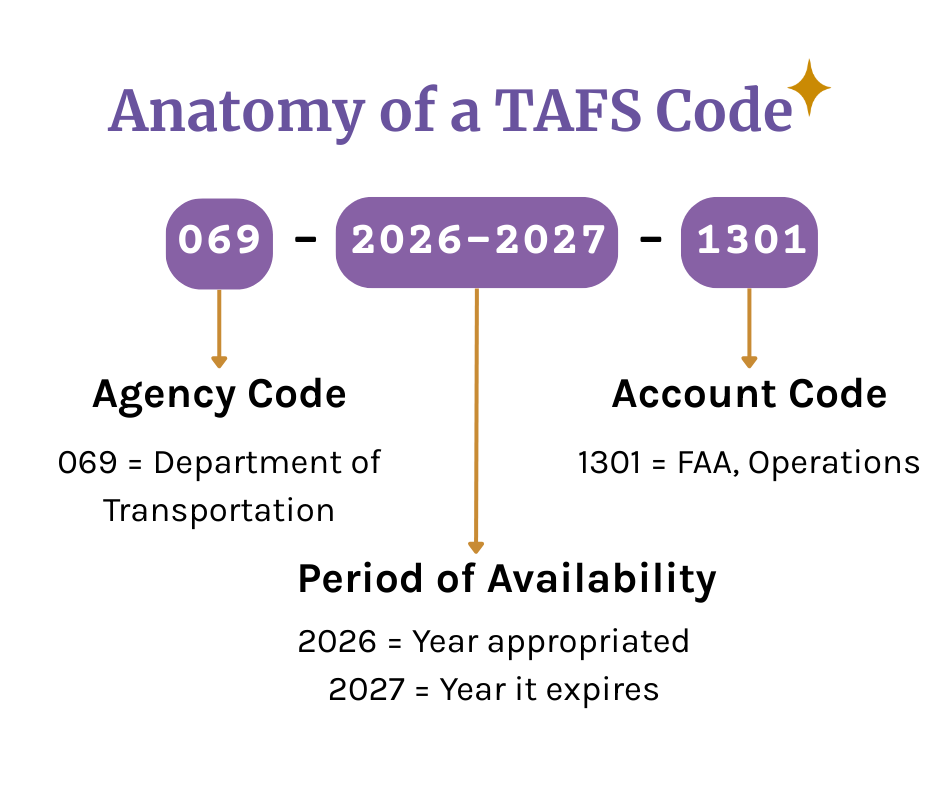

What is a TAFS? The Full Structure

A TAFS has three main components:

- Agency Code

- Period of Availability

- Account Code

Let's break down each component using a real example: 069-2026-2027-1301

This is the TAFS for the Federal Aviation Administration's Operations Account.

Component 1: Agency Code (069)

The first three digits identify the federal agency that manages the account.

069 = Department of Transportation (DOT)

Other common agency codes:

- 075 = Department of Health and Human Services (HHS)

- 086 = Department of Housing and Urban Development (HUD)

- 097 = Department of Defense (DOD)

- 012 = Department of Agriculture (USDA)

- 020 = Department of the Treasury

There are 28 cabinet-level and independent agencies with their own codes. These codes are assigned by Treasury (per the Treasury Financial Manual) and remain consistent across all federal financial systems. Appendix C of OMB's Circular A-11 has a handy chart.

Component 2: Account Code (1301)

The four-digit main account identifies the specific program or appropriation within the agency.

1301 means this account funds Federal Aviation Administration (FAA), Operations. This account funds air traffic controller salaries and other expenses to operate the National Airspace System.

Other DOT examples:

- 1308 = FAA, Facilities and Equipment

- 1129 = Federal Transit Administration, Transit Formula Grants

- 8083 = Federal Highway Administration, Federal-Aid Highways

Component 3: Period of Availability (2026-2027)

These components identify the fiscal year when the funding was appropriated.

2026-2027 means this reflects appropriations made in FY2026 and expires in FY2027.

Wait—why does a single TAFS span two fiscal years?

Translation: Many federal programs receive multi—year funding.

You'll often see the period of availability written with a slash between it, like 2026/2027 or 26/27.

Some other cases:

X = No-year funding (available until fully expended), sometimes /X

2026-2026 = Single-year funding, sometimes /26 or /2026

For more on how single-year vs. multi-year appropriations work, see: How Appropriations Work: Duration and Distribution.

Different Numbering Systems

The TAFS is sometimes written differently based on what document you're looking at.

FAA, Operations is: 069-2026-2027-1301

This is the Common Government-wide Accounting Classification (CGAC) code. The agency number is always three digits. The CGAC codes were developed because many independent agencies shared the same Treasury account codes.

In the SF-133 you'll see: 69-1301 26/27

The SF-133 uses the Treasury code format. Agency codes are 2 digits. The period of availability components are 2 digits, separated by a slash, and come at the end.

In the budget appendix you'd see: 069–1301–0–1–402

This is the account identification code. It has the CGAC agency code, the account code, and information about how it's transmitted to congress, what type of fund it is, and what budget subfunction it is.

In general, the account code is the same in all three, and the difference in the agency code is about a leading zero. Smaller independent agencies map to Treasury codes 48 and 49, but get their own CGAC codes.

If you want to learn more about these systems, the structure, and the rationale behind it, Section 79 of OMB's Circular A-11 covers the budget data system. Appendix C of A-11 has a handy chart of agency codes in the OMB, Treasury and CGAC systems.

How TAFS Codes Work in Practice

Let's trace a real appropriation through the system using TAFS codes.

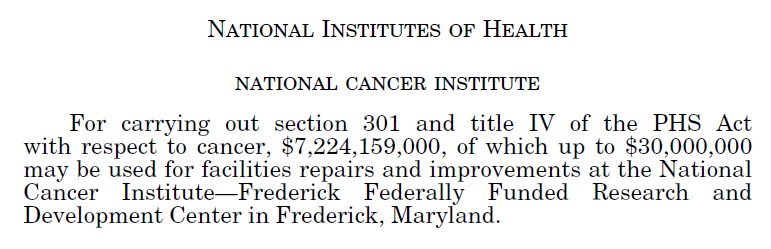

Example: National Cancer Institute

Step 1: Congressional Appropriation

The FY2024 Labor, Health and Human Services, Education appropriations bill includes this language:

There's no TAFS in the appropriations text, but there are ways to figure that out.

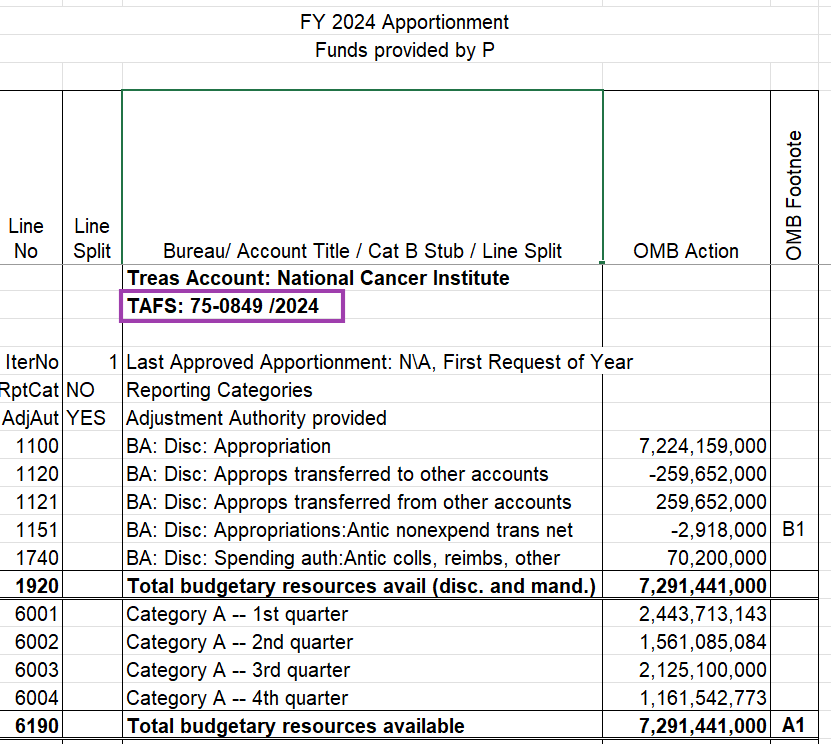

Step 2: OMB Apportionment

HHS submits an apportionment request to OMB, asking to spend the $7.2 billion. OMB approves the apportionment and issues an SF-132 form.

At the top of the apportionment, you'll see:

The heading in the appropriation matches the Treasury Account name, and we see the TAFS for the first time: 75-0849 /2024

You can also see that the appropriation on line 1100, $7,224,159,000, matches the the amount in the appropriation.

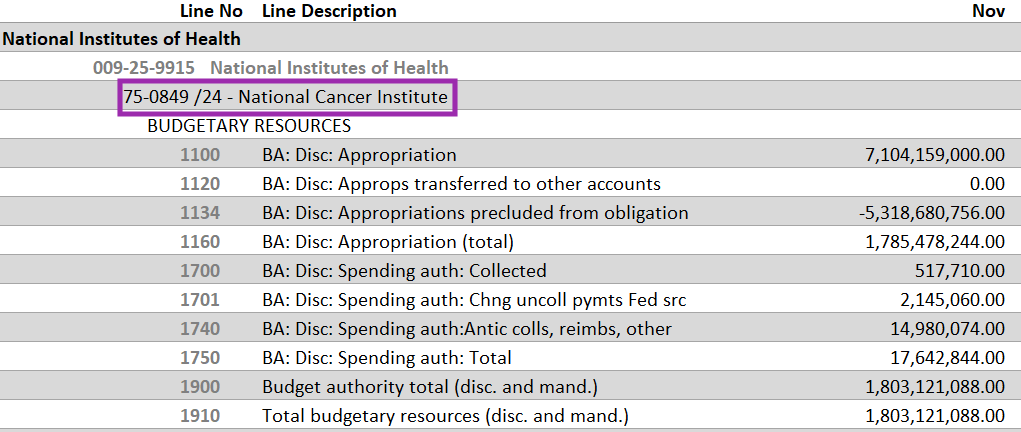

Step 3: Monthly Execution (SF-133)

Each month, HUD reports budget execution data to Treasury through the GTAS system. Treasury publishes this data as an SF-133 report.

In the Excel file, you'll find:

TAFS: 75-0849 /24

Appropriation: $7,104,159,000

Same code again, same appropriated amount again. On the SF-133, you'll be able to see how much of the $7.1 billion appropriation HHS has actually obligated. We'll cover the SF-133 in detail in a future post, but if you scroll down, you'll see a line like this:

2190 | New obligations and upward adjustments (total) | 511,634,897.75

That line shows you the amount of funding actually obligated in November of FY 2024.

Step 4: Award Data (USAspending.gov)

When HHS awards a NIH, National Cancer Institute grant to the University of Iowa, that award appears on USAspending.gov with:

Treasury Account Symbol: 75-0849

Fiscal Year: 2024

Award Amount: $33,008,433.55

Check out the award data here.

Same code one more time. Now you've connected:

- Congressional appropriation ($7.1B)

- OMB apportionment ($7.1B released)

- HHS obligations ($511M through November)

- Individual award to the University of Iowa ($33M)

All linked by one identifier: 75-0049 /24

Decoding Section 249(c): What Programs Were Affected?

Now let's circle back to the question from the beginning: What programs just lost funding in Sec. 249(c)?

Here are the three TAFS codes Congress rescinded:

- 86 X 0148

- 86-2023/2027-0483

- 86 X 0163

Let's decode them:

TAFS #1: 86 X 0148

- 86 = Department of Housing and Urban Development (HUD)

- X = No-year funding (available until expended)

- 0148 = Main account code

What account is this? To find out, you'd look up 086-0148 in Treasury's Federal Account Symbols and Titles (FAST) database. You could also take a look at a SF-133 or an apportionment. OpenOMB.org has a search feature that will help convert a TAFS to a name.

Answer: 086-0148 = Rental Housing Assistance

This is funding for HUD's Rental Housing Assistance program, an older program that pre-dates Section 8 (Housing Choice Vouchers). Most properties that were in this program have converted to other forms of rental assistance, like project-based or tenant-based Section 8.

TAFS #2: 86-2023/2027-0483

- 86 = HUD

- 2023/2027 = Fiscal year 2023 through 2027

- 0483 = Main account code

What account is this? 086-0483 = Preservation & Reinvestment Initiative for Community Enhancement

Translation: This is unspent balances from HUD's Preservation & Reinvestment Initiative for Community Enhancement (PRICE) programs. The program provides grants for infrastructure, planning, resident and community services, resiliency, and other assistance, including land and site acquisition in manufactured housing communities.

TAFS #3: 86 X 0163

- 86 = HUD

- X = No-year funding

- 0163 = Main account code

What account is this? 086-0163 = Public Housing Operating Fund

This is funding for the Public Housing Operating Fund's no-year account. The Public Housing Operating fund is typically appropriated four-year money, like 2026-2029. Congress likely provided these no-year funds for a specific purpose in a prior bill and the ability to spend these funds in a current year is limited.

The Answer

Section 249(c) rescinded unspent balances from:

- Rental Housing Assistance

- Preservation & Reinvestment Initiative for Community Enhancement

- Public Housing Operating Fund

Without TAFS literacy, you couldn't have answered that question. The bill gave you no description—just the codes.

Why this matters: Rescissions are a common tool in appropriations bills. Congress often rescinds old, unobligated balances to "pay for" new spending or to give old money new purposes or new life. But unless you can decode TAFS codes, you can't track what's being cut or evaluate whether the rescissions are hitting active programs or truly old, unused funds.

This is why TAFS literacy is essential for budget tracking.

What TAFS Codes Don't Tell You

TAFS codes are powerful, but they have limits:

They don't tell you program names in plain English

086-0162 is "Community Development Fund," but you'd never know that from the code alone. You need to cross-reference Treasury's account master list or OMB's MAX system.

They don't explain what the money is for

TAFS codes identify accounts, not purposes. To understand what specific projects or activities are funded, you need to read appropriations bill language, committee reports, and agency budget justifications.

They don't track sub-recipient spending

When HUD gives Houston $25M in CDBG funds, and Houston gives $2M to a local nonprofit, the nonprofit spending doesn't appear in federal systems. TAFS codes track federal obligations, not downstream uses.

How to Use TAFS Codes for Budget Tracking

Once you can read TAFS codes, here's your four-step workflow for tracking federal money:

1. Start with the appropriations bill

Find the account title in the bill text, then locate the corresponding TAFS in:

- Treasury's Federal Account Symbols and Titles (FAST) database

- OMB's budget justifications

2. Track the same TAFS through apportionments

Search OMB's apportionment portal or OpenOMB.org for the TAFS code. This shows you:

- How much OMB released to the agency

- When funds were released (by quarter or month)

- Any restrictions or footnotes

3. Monitor execution in SF-133 reports

Download the monthly SF-133 Excel files from MAX.gov and filter by TAFS. Track:

- Line 1910: Obligations incurred

- Line 1020: Unobligated balance

- Line 2190: Outlays

4. Find individual awards on USAspending.gov

Search USAspending.gov by "Treasury Account Symbol" to see every grant and contract funded from that TAFS.

Why This Matters for Federal Budget Transparency

The federal budget is too big for anyone to track manually. We need systems that connect appropriations to execution automatically. But those systems only work if there's a common identifier across all data sources.

TAFS codes are that identifier.

Without TAFS, you're stuck manually matching account titles that change between bills and reports. With TAFS, you can write a script to track every dollar from appropriation through execution.

This is how we'll track impoundments, identify spending delays, and monitor whether Congress's funding priorities are actually being executed. It starts with understanding the components of the TAFS.

Conclusion

The Treasury Account Fund Symbol is the Rosetta Stone of federal spending. It's the code that makes appropriations trackable, apportionments comparable, and execution data meaningful.

Every TAFS follows the same structure:

- Agency (who controls the money)

- Main Account (what program)

- Period of Availability (how long before the money expires)

Without TAFS literacy, you're stuck reading appropriations bills like Section 249 and having no idea what programs are affected. With TAFS literacy, you can decode 86 X 0148, 86-2023/2027-0483, and 86 X 0163 instantly—rental housing assistance, PRICE, and public housing operating fund.

You can connect Congressional intent to agency execution. You can track delays, identify impoundments, and see where money actually flows.

The next time you see 086-X-0192 in an appropriations bill, you'll know exactly what it means: HUD's Homeless Assistance Grants, no-year funding. And you'll know how to track those billions through OMB apportionments, through Treasury execution reports, all the way to the grants that fund homeless shelters in your city.

That's the power of the TAFS.

What's Next

Now that you understand how TAFS codes work, the next question is: What do OMB and agencies do with appropriations after Congress passes them? Over the next few weeks we're going to dive into:

- How to read an apportionment, and

- How to read an SF-133 report (execution of budgetary resources).

But first, we need to spend a minute on getting some terms right. Next week, we'll cover: Appropriations, Obligations, and Outlays: The Three Stages of Federal Spending. If you've ever ordered food at a nice restaurant, you already understand appropriations, obligations, and outlays.

Thanks for reading!

BlazingStar Analytics is building real-time budget execution tracking that connects appropriations, apportionments, and SF-133 reports. Get early access to our platform, launching Spring 2026.